by Jonah Ravel B.A., F.Pl., CFP® (Canada), CFP® (US) | Jul 22, 2024 | Featured, Featured, Health Coverage & Insurance, Immigration

For Canadians moving to the US, the cost of US health care can be daunting. US residents who don’t have access to an employer group plan must typically find an individual policy on the health care marketplace. These plans can be expensive, depending only on three...

by Matt C. Altro B. Comm., F. Pl., CFP® (CAN), CFP® (US) | Oct 28, 2019 | Article, Immigration, News, Tax Filing Requirements, Tax Planning

Globe & Mail – Andrew Scheer is renouncing his U.S. citizenship. Here’s what Americans living in Canada should know With the 2019 Canadian election season now over we are very pleased to announce that Matt Altro, David Altro, Alessandro Tortis were invited...

by Samuel Platel, F. Pl. | Jun 25, 2019 | Immigration, Tax Filing Requirements, Tax Planning

For some Canadians, a new life is waiting in one of 49 states south of the border. But with every new beginning comes some other beginning’s end. For most Canadians moving south, that other beginning’s end is called departure tax (also known as a deemed disposition...

by Matt C. Altro B. Comm., F. Pl., CFP® (CAN), CFP® (US) | Jun 17, 2019 | Article, Estate Planning, Immigration, Tax Planning

Globe & Mail – If your child lives in the U.S., it may be time to revise your will We are very excited to announce that Matt Altro, David Altro, and Zaina Kottis were asked to prepare a special for The Globe and Mail, which was published on June 17, 2019....

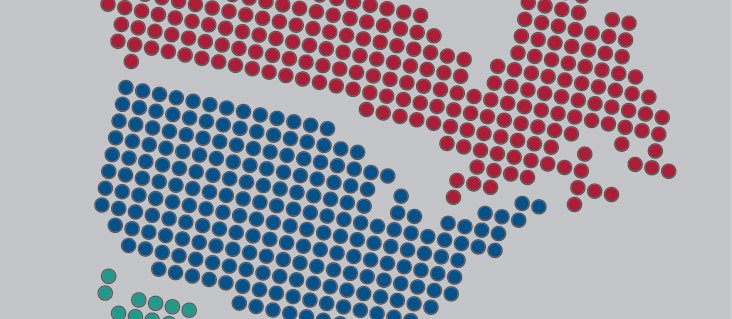

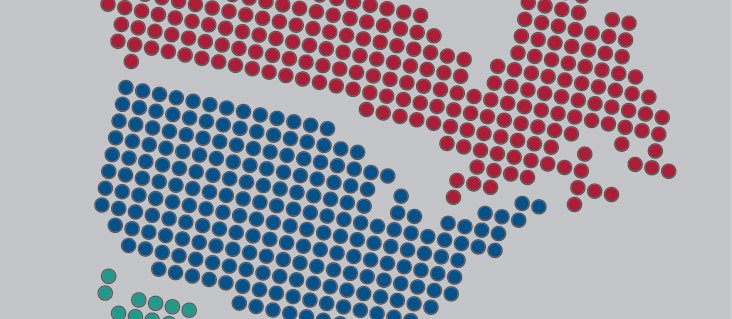

by Matt C. Altro B. Comm., F. Pl., CFP® (CAN), CFP® (US) | Mar 26, 2019 | Article, Immigration, Investment Planning, News

Globe & Mail – Four Tax and Other Financial Considerations for Americans Moving to Canada We are delighted to share that Matt Altro and David Altro were asked to prepare a special for The Globe and Mail, which was published on March 25, 2019. Their article...

by Jeremy Voisin B. Comm., F .Pl. | Mar 13, 2018 | Immigration, News

U.S. president Donald Trump made a promise during his 2016 campaign to pull the U.S. out of the North American Free Trade Agreement (NAFTA). He’s called it the worst trade deal ever signed by the U.S. and a “disaster”. Let’s discuss some...