The Power of Diversification: Safeguarding Your Investment Portfolio

When it comes to building a successful investment portfolio, one of the most crucial principles is diversification. Diversification has become an important strategy in client portfolios over the last few years as a pandemic, wars and political events have significantly affected portfolio returns.

Diversification involves spreading your investments across various asset classes, industries, and geographical regions. In this blog, we will explore the reasons why diversification is essential and how it can help you achieve your financial goals while managing risk effectively.

1. Reducing Risk

The adage “Don’t put all your eggs in one basket” perfectly encapsulates the essence of diversification. By allocating your investments across different assets, you spread the risk. When one asset class experiences a downturn, other assets can potentially perform better, cushioning the overall impact on your portfolio. This is referred to as negative correlation and this risk reduction is particularly vital during periods of market volatility or economic uncertainty.

2. Balancing Returns and Volatility

Different asset classes have unique risk-return profiles. For instance, stocks may offer higher returns but come with higher volatility, while bonds generally provide more stable returns but with lower growth potential. By combining these assets in your portfolio, you can balance their risk and return characteristics, aiming for steady growth while minimizing extreme swings in value.

3. Hedging Against Economic Changes

Economic conditions can fluctuate, impacting various industries and sectors differently. Diversifying across industries can protect your portfolio from significant losses if one sector experiences a downturn. For instance, in 2022, technology and technology related stocks were down 32% as measured by the NASDAQ 100 Index, while the Energy Select Sector SPDR ETF was up 64%.

4. Capturing Growth Opportunities

Diversification not only reduces risk but also allows you to capture growth opportunities across different markets. Some assets may perform well during specific economic conditions or phases of the business cycle. By diversifying, you increase the likelihood of benefiting from growth in different areas of the market.

5. Geographic Diversification

Investing solely in your home country’s assets exposes you to country-specific risks. Geographical diversification allows you to benefit from global growth opportunities and reduces the impact of regional economic challenges. Investing in emerging markets, for example, can provide exposure to rapidly growing economies and potentially higher returns.

6. Psychological Benefits

Diversification can provide psychological benefits to investors, especially during turbulent times. Seeing a well-diversified portfolio can instill confidence and reduce the temptation to make impulsive decisions based on short-term market fluctuations.

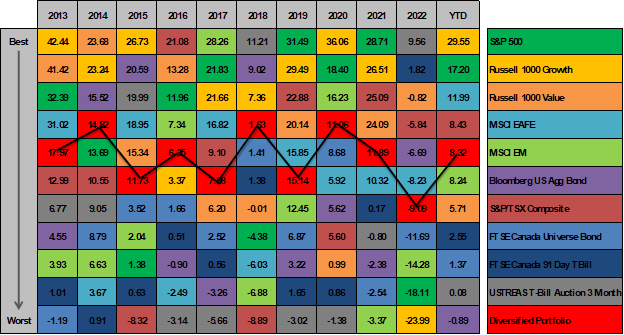

The above benefits can be summarized in the following table which shows annual returns for various asset classes vs. a Diversified Portfolio of 40% Bonds and 60% Stocks. As you can see, individual asset classes can significantly fluctuate year to year, while a Diversified Portfolio considerably reduces volatility to provide consistent long-term returns.

*Source: Morningstar Direct. All returns are in Canadian Dollars.

Diversified Portfolio: 2.5% USTREAS T-Bill, 2.5% FTSE Can 91 Day T-Bill, 17.5% Bloomberg U.S. Agg Bond, 17.5% FTSE Canada Universe Bond, 15% S%P 500, 15% S&P/TSX Composite, 10% Russell 1000 Growth, 10% Russell 100 Value, 5% MSCE EAFE, 5% MSCI EM.

In conclusion, diversification is a fundamental strategy for any investor looking to build a robust and resilient investment portfolio. By spreading investments across different asset classes and regions, investors can achieve a balance between risk and return, protect their portfolio from market volatility, and capitalize on growth opportunities.

Remember that diversification does not guarantee profits or protect against losses, but it can significantly enhance your ability to weather unpredictable events and achieve your long-term financial objectives. As you embark on your cross-border investment journey, consider consulting with MCA Cross Border Advisors Inc. to develop a personalized diversification strategy aligned with your risk tolerance, financial goals, and cross-border tax considerations.

MCA Cross Border Advisors, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. The content of this presentation is for information purposes only and should not be construed as investment or financial advice. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.