President Obama’s recent State of the Union address focused on closing the income inequality gap. To achieve that goal, the President unveiled a plan to raise capital gains taxes for the rich – his two key capital gains proposals target the top 1% of US taxpayers.

Unsurprisingly, the proposals, outlined below, face heavy opposition from a Republican-dominant Congress. If the proposals do become law despite Republican pushback, most Canadians who are planning a future move to the US will be unaffected by the tax hikes, which are aimed at the ultra-wealthy.

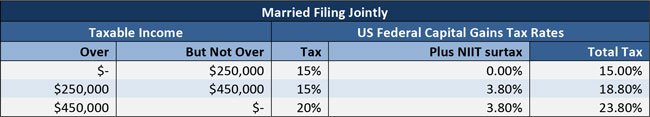

1. Capital Gains Tax Rate Increase

2. Impose Capital Gains Tax at Death and Close the Step-Up Loophole

Canadians are deemed to dispose of their property at fair market value (“FMV”) upon death. Capital gains tax is owed on the accrued gains of all assets other than the principal residence, payable when a deceased’s last income tax return is filed.

US death tax is different: instead of imposing capital gains tax on assets at death, the US government levies estate tax on the FMV of a US citizen’s assets when he or she passes away. There is a $5.43 million exemption available that prevents the estate tax from being applied to most Americans. (The efficacy of this tax is continuously debated in the US, but it remains law and will likely be in place for the foreseeable future).

Under current US law, it is possible for wealth to be passed down to heirs tax-free on assets that have accumulated gains. Consider a US citizen and resident who is exempt from US estate tax. If he or she passes away owning stocks that have increased in value from $100 to $500 a share, under current law, the deceased’s estate won’t owe any capital gains tax on the $400 per share gain upon death, and his or her heirs will inherit the stocks on a tax-free basis.

What’s more, the heirs’ cost basis will be “stepped-up” to $500, so any future capital gains tax will be determined using $500 as the basis.

President Obama hopes to close this loophole. If his proposal becomes law, capital gains tax would be owed on death, as it is in Canada.

Many Canadians planning to move south of the border are unaware that there is currently no capital gains tax payable on death in the US. Those who fall under the $5.43 million per individual/$10.86 million per couple US estate tax exemption can benefit from this tax-savings opportunity if they put the proper tax and estate plans in place prior to moving; with the appropriate strategies, Canadians who fall under the US estate tax exemption will also avoid Canadian capital gains tax on death (since they will be residents of the US), and they won’t have any US capital gains tax to pay.

President Obama’s proposal to impose capital gains tax at death would hinder such planning. However, his proposal, if passed, includes the following safeguards, aimed at protecting the majority middle-class from exposure:

- Individuals would receive a basic $100,000 exemption, and couples would receive a $200,000 exemption.

- For couples, capital gains tax would only be due upon death of the second spouse.

- Couples would continue to receive a $500,000 principal residence exemption; individuals would continue to receive a $250,000 exemption for their principal residence (these exemptions are currently in place for couples and individuals).

- Tangible personal property like furniture and small family heirlooms would be excluded from capital gains tax at death.

- Small family-owned and operated businesses passed down to heirs would not incur capital gains tax unless they were later sold, which is when tax would become due.

- Any estate tax owed by a deceased would be offset by the amount of capital gains incurred upon death, avoiding double taxation.

Who Would Be Affected?

According to The White House, these two proposals, if passed, would really only impact the top 1% of taxpayers in the US. And the top .1% of that small percentage (people with income of about $2 million or more) would be impacted the most; most Canadians who are thinking of moving to the US wouldn’t be affected by these tax hikes at all.

Canadian residents who pass away owning US vacation property may not be exposed to US estate tax, but may instead become exposed to capital gains tax in the US if President Obama’s proposal is successful. However, foreign tax credits under the Canada US Tax Treaty would prevent double taxation between Canada and the US.

Conclusion

If President Obama’s tax proposals become law in a Republican-controlled Congress – and it’s a long shot that they will – they will only affect the ultra-wealthy. This is good news for most Canadians who are planning a move to the south.

MCA Cross Border Advisors will continue to follow this story and will provide updates as they become available.