Globe and Mail – Snowbirds, will there be tax to pay when you sell your U.S. property?

To read the article you can see it in part below, or click here to view it on The Globe and Mail’s website.

Snowbirds, will there be tax to pay when you sell your U.S. property?

David Altro and Matt Altro

The Globe and Mail

May 15, 2018

There are many answers to the question of whether you need to pay tax on the sale of your U.S. property. Just ask your neighbours sitting around the community pool at your Sunshine State resort. We call them poolside lawyers. Lots of information, but not necessarily correct information.

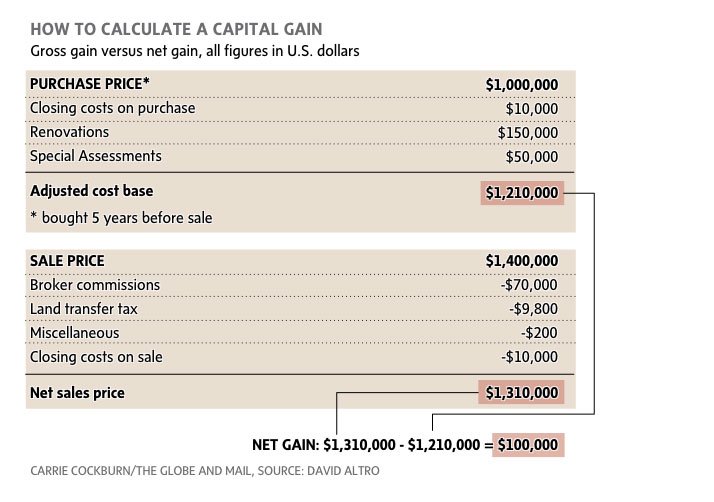

How to calculate a capital gain

Let’s say Bob and Pat bought a condo in Naples, Florida for $1 million (U.S.) five years ago and took title in a cross border trust. If they receive an offer for $1.4 million (U.S.) today, $400,000 (U.S.) appears to be the gain. That amount is more accurately called the “gross gain.”

Gross gain versus net gain

Let’s try to reduce that gain for tax purposes using the following information:

Uncle Sam wants the tax

The IRS will tax the net gain because the property is located in the U.S. The tax rate will depend on how title was held. If Bob and Pat bought personally or in a cross border trust, the IRS rate would be up to 20 per cent the net gain ($20,000 U.S.). If title was held in a Canadian corporation, the IRS rate would be 21 per cent under the new U.S. tax act, while the Florida state tax would be an additional 5.5 per cent. (Note that Florida doesn’t tax individuals or cross border trusts.) By the way, if you buy and sell in less than 12 months, where title is in your name personally or in a trust, the IRS tax rate is 37 per cent!