Canada Pension Plan: To Elect or Not to Elect, That is the Question

Whether or not to take Canada Pension Plan (“CPP”) benefits early, before the normal retirement age of 65 years old, has always been a pressing question for Canadians. (Americans face the same pressing question with respect to Social Security pension benefits, which I’ll discuss later in this blog). The youngest age at which a Canadian can elect to take CPP benefits is age 60. However, Canadians who elect to begin receiving CPP benefits early will receive their benefits at a reduced rate for the remainder of their lives. (Note that the current rate of reduction has been set at 0.6% per month by the federal government, and there are no current plans for this rate to change.) By contrast, Canadians who elect to begin taking their CPP benefits between 65 and 70 (the oldest age at which one can elect to begin receiving benefits) will receive full CPP benefits without any reduction. Moreover, each monthly payment received after the age of 65 up until age 70 will be increased by 0.7% per month.

The Breakeven Age

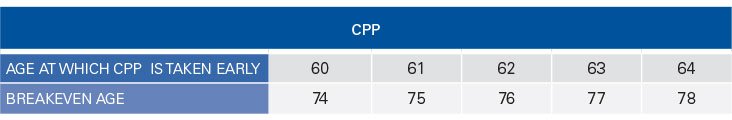

Whether or not you should take CPP benefits early depends on a variety of factors. One useful factor to consider is the “breakeven age.” I have calculated the breakeven ages for 2016 to assist Canadians who are currently contemplating whether to take CPP early.

My findings are shown in the table below. The top row shows the different ages at which CPP can be taken early. The bottom row shows the breakeven age. The breakeven age is the age at which the total amount of reduced CPP benefits received by someone who begins collecting CPP before 65 becomes equivalent to the total amount of full CPP benefits that that same person would receive if they waited until 65 to begin collecting CPP.

Calculations were made using information from the Government of Canada and by adding up the amount of payments that would be received each month if a retiree took reduced CPP at the ages between 60 and 64 versus taking full CPP at age 65. Calculations assume that a retiree would receive the maximum amount of CPP benefits available as someone who contributed the maximum amount to the program throughout their working life.

An example will help clarify what the above breakeven ages mean.

Let’s assume Diana, a Canadian, turns 60 years old this year, and she decides to begin receiving reduced CPP benefits starting on her birthday. Diana will begin collecting CPP right away, but she will receive a reduced rate moving forward. Based on the above table, if Diana starts collecting reduced CPP at 60, then by the time she is 74, she will reach her breakeven age, which is the point at which she will have received the same amount of benefits as if she had begun taking full benefits at age 65.

Since Diana began collecting CPP before 65, after her breakeven age of 74, she will continue to earn reduced benefits. However, if Diana waits until she is 65 to begin collecting CPP and therefore receives full benefits, then after her breakeven age of 74, she will continue to earn full benefits for the remainder of her life. Ultimately, then, Diana will earn more CPP benefits after age 74 if she waits until she is at least 65 to begin collecting them.

For the breakeven age to be a truly useful benchmark, then, it must be viewed within the context of one’s projected life expectancy. Diana should therefore try to determine her life expectancy to see whether it is actually a good financial decision to take her CPP this year, when she turns 60. If she expects to live beyond 74 years of age, it might actually be preferable for Diana to take CPP at 65 or later so that she can receive more benefits over her lifetime.

Indeed, if Diana’s life expectancy is longer than average – for example, 95 years of age – then she will likely decide to wait and take CPP after she is 65. That way, she will receive full CPP benefits throughout her long life, which she can use to cover a variety of expenses, such as the cost of health care, which may rise as she ages.

If, however, Diana has a history of family disease and she anticipates that her life expectancy will be low – for example, 75 – she will still want to take CPP as early as possible, at age 60, in spite of the reduction she will face; that way, she will be able to enjoy her benefits for a longer period of time while she is alive (waiting until she is 65 to begin receiving CPP means Diana will lose out on receiving five years of benefits that she can enjoy while she is alive and, hopefully, healthy). In this situation, it’s basically irrelevant that Diana will earn reduced benefits after her breakeven age of 74 since she doesn’t expect to live much longer than that. If her life expectancy is lower than her breakeven age – 67, for example – then the fact that she will earn reduced CPP income after 74 becomes totally irrelevant, and Diana should take CPP at 60 in order to use as much of her CPP income as possible before she passes away.

Of course, life expectancy predictions are not always accurate, so it’s prudent to consider additional factors when deciding whether to take CPP early.

Projected Taxable Retirement Income

Another factor for Diana to consider is her projected taxable retirement income and how this projected retirement income will affect two issues: her exposure to recovery tax and her projected marginal income tax rate.

First, if Diana is certain that she will retire with a large pension over a certain threshold, then taking CPP early and at a reduced rate might be a useful retirement planning strategy. For example, under current federal law, Canadian residents are subject to Old Age Security (“OAS”) recovery tax; due to this tax, OAS is “clawed back” if a resident’s total annual income exceeds $72,809 CAD. (The amount of the clawback is 15% of the amount by which one’s total income exceeds the threshold or the amount of the OAS payment, whichever is less.) If Diana projects that her annual retirement income will be over $72,809 CAD if she takes her full CPP at 65 or later, then by taking CPP early and at a reduced rate, she might be able to decrease her annual income enough so that she won’t be subject to OAS recovery tax.

There are other federal “income-tested” credits, such as the Age Credit, which she might also be able to keep from being clawed back by reducing her annual income. By taking CPP early and at a reduced rate, Diana might also reduce her annual retirement income enough so that she finds herself in a lower tax bracket than she would otherwise be in if she took full CPP payments at 65 or later.

US Social Security

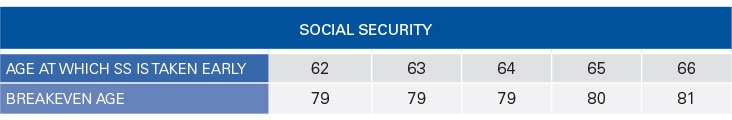

Americans who elect to receive Social Security (“SS”) benefits early face issues similar to those faced by Canadians who choose to receive CPP early. In the US, however, the rules differ slightly. First, the earliest you can elect to begin receiving pension is 62 years old and the normal retirement age is 67. Second, SS benefits taken early are reduced at a rate of 0.56% per month for the first three years before the age of 67 and at a rate of 0.42% per month thereafter.

The below table represents the breakeven ages for an American retiree who is born in 1960 or later and chooses to take SS early. Information was taken from the US’s official SS website to create these calculations, which were executed in the same manner as the CPP calculations.

Note that in addition to evaluating the breakeven ages above in the light of life expectancy, American retirees should also evaluate other considerations when deciding whether to take SS early, such as their projected annual retirement income and eligibility for government pension benefits in addition to SS.

Investing Pension Payments

Another factor to consider is whether or not a retiree plans to invest his or her pension payments. If a retiree plans to invest some or all of their government pension income, it might make more sense for them to take their government pension early in order to maximize the amount of time that they have to invest these earnings. An analysis should be run to see if taking pension early and investing it would be more financially beneficial than waiting to take pension later and receiving full benefits. The outcome of such an analysis will depend on various factors, such as the amount of pension income that will be received, how much of that income a retiree plans to invest versus how much of that income the retiree plans to spend, the projected rate of return and the retiree’s life expectancy.

Cross-Border Considerations

Canadians who are planning to move to the US or who are already US residents have other issues to consider as well. Pursuant to the Canada-US Income Tax Treaty, Canadian citizens who are US residents are not subject to a clawback on their OAS. Therefore, they may not need to lower their annual income by taking CPP early and receiving it at a lower rate. If the Canadian-citizen US resident is also eligible to receive SS or other US government pensions, then they should analyze the way the IRS treats these pensions and how this treatment may or may not affect their cash flow as US residents.

Conclusion

This blog is a general guide that can help you determine whether or not to take CPP or SS early. Without a full, detailed analysis of your particular situation, however, it is difficult to conclude the best course of action, especially if you live a cross-border lifestyle. In such situations, we recommend consulting with a cross-border financial planner to receive an in-depth and personalized analysis about how to maximize your government pensions.

——–

MCA Cross Border Advisors, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.